FOMO (Fear of Missing Out) is being held responsible for driving up recent property prices in Australia. As a result, predicting a sale price is becoming more and more difficult in this very heated property market. Even experienced real estate agents are at a loss to accurately predict prices. So, can the FOMO effect be measured? And how do you know if FOMO may be impacting your judgement?

Why are property values so hard to predict right now?

The current property comparison method and existing free online tools are no longer that helpful or accurate. They don’t measure the two most important factors which are pushing property prices up into uncharted territory. These two poorly measured factors include current market conditions and secondly, emotional factors, aka. FOMO.

How are property market conditions calculated?

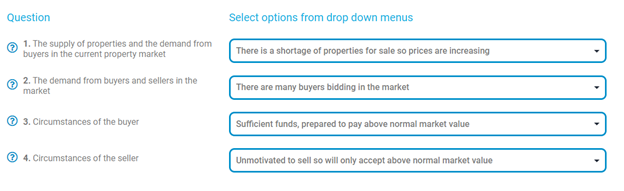

To measure the current market conditions, it comes down to the simple economics of supply and demand. For supply, how many properties are currently up for sale? Then for demand, how many buyers are currently active in the market?

How are emotions of buyers and sellers measured?

For emotions, we need to determine the emotional and personal circumstances of the buyers and sellers. Emotion is best demonstrated at a property auction when a bidding war emerges between a few remaining buyers. Emotions overtake logic when the fear of missing out is greater than the bid it will take to secure the property. Defining the underlying property value and predicting how much the final bid will be is how we can measure the value of that emotion.

The problem with current valuation methods

Most valuation methods today mainly use recent sales in the same area to calculate value. What’s missing is a tool that specifically measures and assigns a dollar value to current market and emotional circumstances along with specific property features.

Changing the model for property valuation in Australia

After significant research and mathematical testing, we developed PropertyPricer. This online tool enables both buyers and sellers to value any property by considering its special features and unique characteristics. It also enables users to choose from several options to reflect the current market and emotional circumstances.

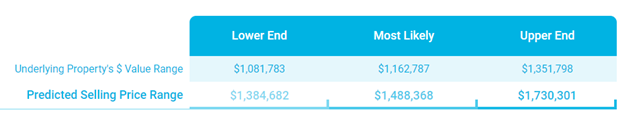

By completing a PropertyPricer valuation, buyers and sellers have both the underlying value and predicted selling price in the current market. Buyers know whether to keep increasing their bid, whereas sellers know when to accept or reject an offer.

In an auction scenario, the further away the bidding goes from the underlying value and towards (or even over) the predicted selling price, care should be taken so that emotions do not cloud your judgement on the final offer.

If you think FOMO might affect your judgement at an upcoming auction, getting a reliable figure for the predicted selling price is good to have in your back pocket. This will prevent you from getting carried away in the heat of a competitive auction and give you the necessary reality check.

PropertyPricer is an independent online property valuation tool which not only calculates current market conditions and emotions. It is also the only property valuation tool which measures specific property features combined with current Core Logic property data to accurately predict property prices.